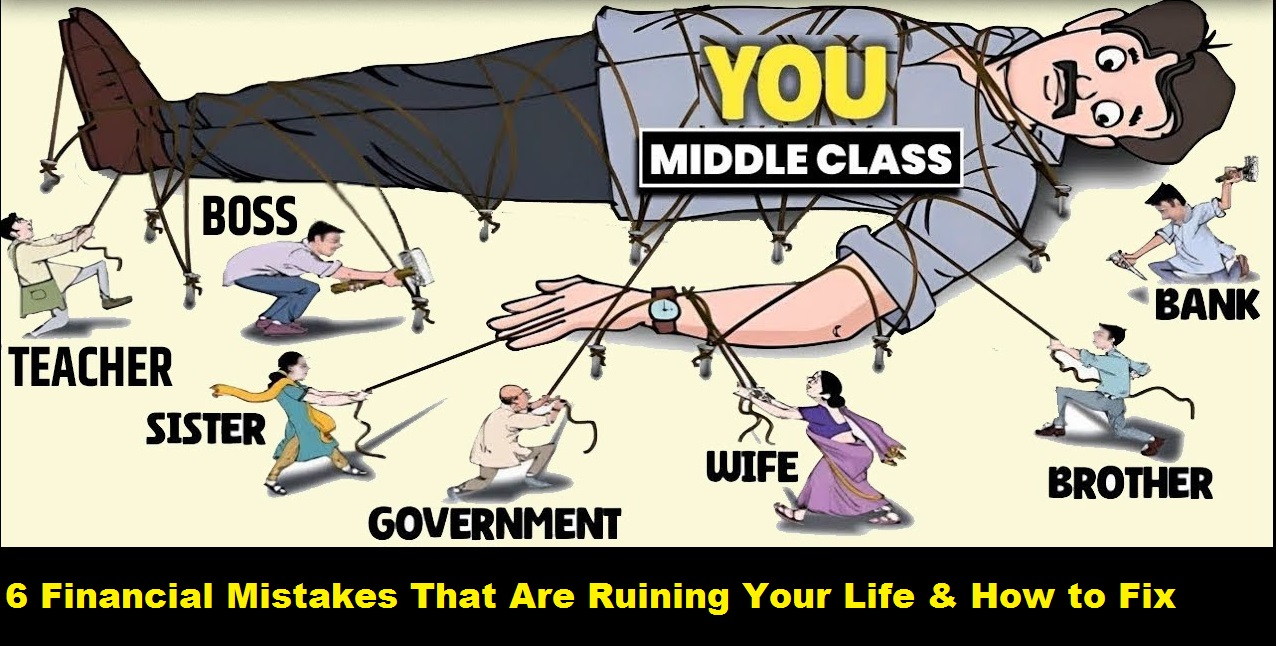

Warren Buffett once said that liquor, ladies, and leverage are the three “L’s” that can ruin even the smartest person’s life. While the first two might be obvious, it’s the third “L,” leverage or debt, that often traps middle-class individuals, turning their lives into a living nightmare. The wealthy use leverage wisely to grow richer, but many middle-class people get entangled in a web of debt that’s nearly impossible to escape. And that’s not all; many financial mistakes keep dragging them deeper into a financial pit. Today, we’ll explore six such mistakes that are destroying your finances and leading you toward a place from where escape seems impossible. Stick around until the end because I’ll also share three solutions that can save your life from going downhill.

Mistake #1: Investing Late

Many people know how to earn money, but investing it wisely and at the right time is a different story. In India, only 27% of adults and 17% of teenagers are financially literate. Most people are excellent at spending but clueless when it comes to investing. Let’s break it down with an example. Imagine you’re 22 years old, and you start investing ₹50,000 monthly. If you increase your investment amount by 10% each year, by the time you’re 32, you’ll have accumulated around ₹17 lakh. Fast forward to age 42, and your wealth could grow to ₹1 crore 10 lakhs.

However, if you delay your investments by 10 years and start at 32 instead, by the age of 42, your wealth would only be around ₹22.4 lakhs. And by the time you’re 52, you would have accumulated just ₹2 crore 20 lakhs compared to the ₹5 crores you could have had if you had started earlier. Moreover, delayed investments also mean facing the wrath of inflation, which steadily erodes the value of your money. So, never invest late—invest early and wisely.

Mistake #2: Falling for the Influence Culture

In today’s digital age, we are surrounded by both good and bad influences, and the biggest weapon of this negative influence is the mobile phone. Every child today is familiar with social media and has a favorite influencer. According to a report from IIM Rohtak, young Indians spend an average of 6-7 hours on social media platforms, with 60% of this time spent after office hours watching their favorite influencers. They try to imitate their lifestyles, whether it’s buying expensive cars, branded bags, or dining at fancy restaurants.

This constant need to keep up with influencers leads to unnecessary spending, which often eats up 75% of the salary within the first 15 days of the month. The result? No savings, no investments, and a financial mess that could have been avoided.

Mistake #3: Getting Trapped in Debts and Pay Later Schemes

Many people believe that money will never run out, and even if it does, they have loans and pay-later apps to fall back on. After blowing their salary within the first 15 days, they turn to their phones to find offers like “Credit Card with ₹1 lakh limit,” “Personal Loan up to ₹5 lakhs,” or “Buy Now, Pay Later.” Once you click, you’re trapped in a cycle of debt that’s hard to escape. By 2023, Buy Now Pay Later schemes have reached $14.3 billion in India, projected to grow to over $25 billion by 2028. The interest rates on these loans can range from 20% to 32%, yet most people aren’t aware of this, continuing to spend money they don’t have.

Mistake #4: Over-Reliance on Online Shopping

With apps like Blinkit, Zomato, Zepto, and Swiggy, everything you need is just a click away. But while the convenience is great, many people fail to notice the platform fees, handling charges, and extra taxes that turn a ₹150 order into a ₹300 expense. A clear example is when a customer ordered six idlis from a restaurant on Zomato, where the restaurant’s bill was ₹132, but the final Zomato bill was ₹198, thanks to the extra charges.

I’m not saying that online platforms are bad, but where savings are possible, you should put in a little effort to save money instead of spending unnecessarily.

Mistake #5: Paying for Gambling Apps

There’s a story of a 25-year-old named Santosh, who lost ₹4.4 lakhs on a betting app. The money was supposed to be his tuition fee, but he blew it all after being introduced to the platform by a friend. The temptation of easy money led him to gamble away his future. This is not an isolated incident. Many people fall into the trap of gambling apps, losing significant amounts of money in the process. They are more willing to risk their hard-earned money on uncertain bets than to invest in secure avenues like the stock market, which they consider too risky.

Mistake #6: Luxury Spendings

Lastly, luxury spending is a common trap. You might go to a mall just to hang out, but end up buying unnecessary items and leaving with a hefty credit card bill. The psychology behind this is simple: malls are designed to make you spend. From luxury cars on display to strategically placed top-brand shops, everything is arranged to tempt you. Even if you manage to avoid spending on the first floor, by the time you reach the third, something will catch your eye. And don’t forget the food courts, usually located on the top floor to ensure you spend money before you leave.

Solutions:

Now that we’ve identified the problems, here are three solutions to avoid these financial mistakes:

- Avoid the Influence Culture: Social media is a significant time sink, and blindly following influencers can lead to poor financial decisions. Instead, focus on your mental health and financial well-being, and avoid getting caught up in the influence culture.

- Always Know Your Interest Rate: Credit cards are common, but they’re not free money. Many people make the mistake of paying only the minimum amount due, unaware that the remaining balance accrues interest at rates as high as 18% to 35%. Always pay off your full balance to avoid falling into this trap.

- Build a Strong Financial Plan: A strong financial plan is asset-driven, not liability-driven. Focus on building wealth early on, and avoid luxury spending until you’re financially secure. By doing so, you’ll be able to retire comfortably and enjoy your life without financial stress.

Conclusion:

These six money mistakes are common, but they can have severe consequences if not addressed. The good news is that by recognizing these pitfalls and implementing the solutions mentioned above, you can secure your financial future and avoid the traps that so many others fall into. Which of these mistakes have you been making? Let us know in the comments, and if you found this post helpful, please share it with others so that more people can benefit from these insights. Don’t forget to subscribe for more such content!